FUTURE

SHOPPERS

Shoppers everywhere are changing. Our report

investigates who shoppers are, what drives

their shopping behaviors, and how they

expect to shop in the future.

1 / 32

HOW WELL DO YOU KNOW YOUR FUTURE SHOPPER?

ABOUT

We surveyed over 5000 consumers across France, Germany, U.K., USA and China to get to know them better. Meeting customers' needs is no longer just about understanding what they feel about price and product, but catering for them as individuals with lots on their minds and substantial experience in new technologies under their belts.

Itʼs time to look at your shoppers anew to better prepare for the retail of tomorrow.

2 / 32

INTRODUCTION

By now we’re all aware of the extent to which technology has accelerated over the last few years, but we could spend so much time evaluating and improving our digital capabilities that we forget to touch base with who it's all for: the shopper.

Our report suggests something is happening to modern shoppers. Have you noticed it too? There seems to be a homogenization underway where ideals and expectations are merging across demographics and geographies: many shoppers want the same things including the best price, great rewards for their loyalty, meaningful personalization and – increasingly – for brands to have strong Environmental, Social and Governance (ESG) principles.

With the most popular shopper personality being a ‘Basics Buyer’, it also seems the age of abundance is over, and shoppers may be making more considered choices, in turn increasing competition.

Of course, there is a difference between sharing beliefs around what constitutes a good shopping experience and the multitude of factors that make individuals who they are. That’s where advanced personalization can play an important role: because whilst your shoppers may share high expectations, they certainly each have their own needs, styles and dreams.

Modern shoppers are multi-channel enthusiasts, open-minded about the new era of retail.

A next-level omnichannel shopping experience can come together when merchants place their shoppers at the heart of all efforts: communications, price, user-experience, choice and ethics. To do this meaningfully, you must know who they are and what matters to them.

These are your Future Shoppers. We’re excited for you to meet them and hear from their own mouths what they want now and next.

Pinar Koygun

Senior Director, Global Retail

3 / 32

Pru, 24

BIG SPENDER

Having moved from intern, to grad to executive, she is starting to cultivate her shopping habits – and that means having more of what she fancies. With no dependents nor mortgage, this is the time to travel whenever she can and experiment with her style.

If you’re a Big Spender…

You enjoy shopping and regularly splash out on what your heart desires. This might take the form of impulse purchases but also planned ones. Either you donʼt have much debt or arenʼt too worried about accumulating it: life is for living now!

At a glance

5 / 32

At a glance

Our Big Spenders make up the smallest group of respondents – just 3% rating this as their primary shopper type, and a further 4% selecting it as their second.

Though they are more likely to be between 18 and 35 years old, only 5% of Gen-Z and 4% of Millennials identified this way. Of our respondents, they are the group most likely to make

a cross-border purchase.

With many people adjusting their approach to shopping due to macro-economic factors and concern for the environment, is the Big Spender shopper type waning for good, or just for now?

6 / 32

7 / 32

35%

of our Big Spenders are aged 18-26

Global

Big Spenders

by age

18-26 |

35% |

27-35 |

28% |

36-42 |

17% |

43-58 |

14% |

59-70 |

3% |

71+ |

3% |

29%

of our Big Spenders reside in Germany

Where Big

Spenders live

Germany |

29% |

USA |

25% |

France |

22% |

U.K. |

20% |

China |

4% |

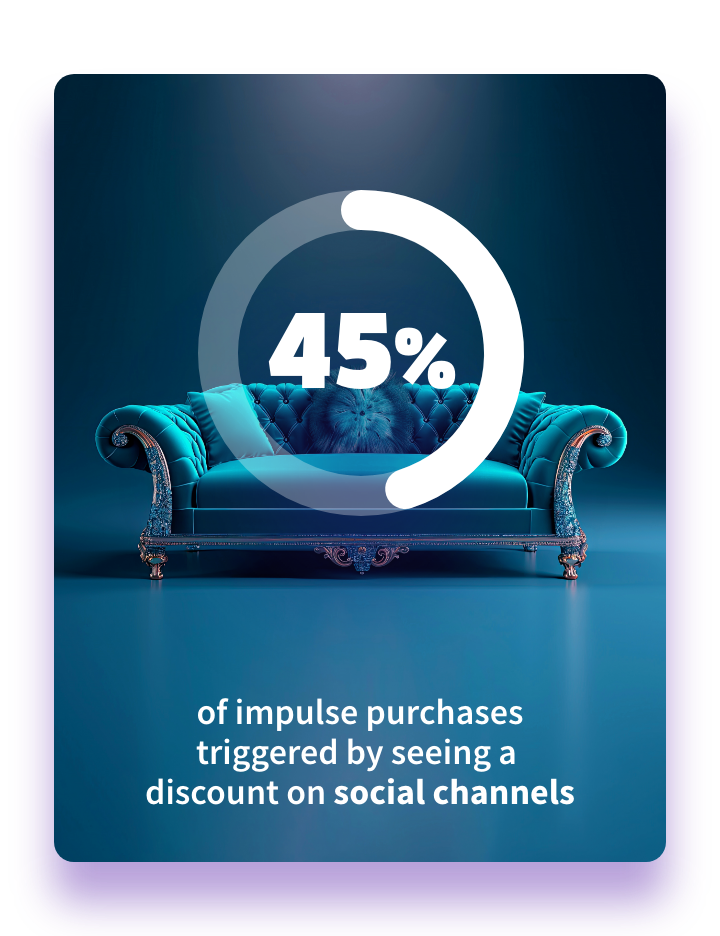

of our Big Spender impulse purchases are triggered by a discount through a social channel

MOST USED PAYMENT METHODS

#1 TOP CHOICE PAYMENT METHOD

Big Spenders data

8 / 32

Silvia, 38

TRENDSETTER

Being a tech wizard herself, she enjoys staying up to date with the latest trends in all areas of life, including how she shops.

If you’re a Trendsetter…

You’re on the cutting edge of new products and technologies. You research the latest product launches and are an early adopter – a digital whiz who gets excited by cool new experiences like augmented reality. You’re regularly using apps to shop and expect delivery to be next-day – maybe even the same day. You want your shopping experience to be fast, flawless and future-forward.

At a glance

9 / 32

Trendsetters may be a rare type of shopper but don’t underestimate their influence on others. Six percent of respondents identified as this profile as their #1, but a further 10% identified it as their #2.

Trendsetters are more likely to be Millennials or Gen-Z but have some representation in the older

age groups too. They shop through more channels than the other groups and embrace new technologies like shopping via augmented reality (19%), shopping through a livestream (27%),

and even shopping through the Metaverse or other digital worlds (14%).

How Trendsetters shop, others follow!

10 / 32

11 / 32

29%

of our Trendsetters are aged 18-26

Global

Trendsetters

by age

18-26 |

29% |

27-35 |

23% |

36-42 |

23% |

43-58 |

16% |

59-70 |

5% |

71+ |

4% |

29%

of our Trendsetters reside in China

Where

Trendsetters live

China |

29% |

Germany |

25% |

USA |

21% |

U.K. |

17% |

France |

8% |

of Trendsetters are open to shopping through a livestream on social or a website

MOST USED PAYMENT METHODS

#1 TOP CHOICE PAYMENT METHOD

Trendsetters data

12 / 32

Clover, 22

ASPIRATIONAL SHOPPER

She’s an Aspirational Shopper with a whole lot of Conscientious Consumer mixed in! She loves sustainable fashion and wants to know fairness is employed by brands right across the supply chain.

If you’re an Aspirational Shopper…

You love the experience of shopping, even if your spending appetite is larger than your discretionary budget. You enjoy curating wish-lists, following your favorite brands on social channels and researching products on shopping apps. You’re already an expert on your chosen retail passions and can’t wait for your budget to catch up with your desires!

At a glance

13 / 32

Aspirational shoppers are the fourth most popular group at 10%. Adding those who selected it as their second choice persona, they surge to a quarter of all respondents.

This brand-led group wields significant shopper power, especially in light of their self-declared ambition to eventually be able to spend more.

Time will tell whether they become Big Spenders or continue with a considered approach.

Aspirational Shoppers take time to get to know retailers and reward them for getting to know them in return. They are the brand advocates among the shopper types, along with likeminded Trendsetters.

Like Trendsetters, they embrace technology, being almost as tech-savvy. In fact, they are the most technologically experienced group when it comes to the checkout, with 33% having used one-click checkout, 32% having used checkout-free stores, and 44% having used advanced checkout technology like scan-and-go.

14 / 32

15 / 32

25%

of our Aspirational Shoppers are aged 27-35

Global

Aspirational

Shoppers

by age

18-26 |

18% |

27-35 |

25% |

36-42 |

20% |

43-58 |

23% |

59-70 |

8% |

71+ |

6% |

36%

of our Aspirational Shoppers reside in China

Where

Aspirational

Shoppers live

China |

36% |

U.K. |

19% |

USA |

18% |

Germany |

14% |

France |

13% |

of Aspirational Shoppers have already used advanced checkout technology like scan-and-go

MOST USED PAYMENT METHODS

#1 TOP CHOICE PAYMENT METHOD

Aspirational Shopper data

16 / 32

Vikram, 48

CONSCIENTIOUS CONSUMER

With two children in primary school, he’s concerned about their futures and wants to ensure he’s doing everything he can to be environmentally aware.

If you’re a Conscientious Consumer…

You’re driven by environmental issues, brand ethics and sustainability. You’re conscious of your carbon footprint and of buying local, seasonal and pre-loved items. You consider your purchases to be votes for the causes you care about. You’re loyal to brands that support the policies that matter most to you.

At a glance

17 / 32

With 22% of respondents identifying as Conscientious Consumers as their first choice, and 21% as their second, this group makes up a large chunk of shoppers: those building ESG values into their shopping choices are far from a fringe group.

However, 73% of shoppers across our whole survey thought the environment and sustainability might play a part in where they choose to shop over the next three years.

With this in mind, merchants may want to look at their sustainability credentials now and ensure they’re ready for a more environmentally-aware future shopper.

18 / 32

19 / 32

23%

of our Conscientious Consumers are aged 43-58

Global

Conscientious

Consumers

by age

18-26 |

16% |

27-35 |

18% |

36-42 |

18% |

43-58 |

23% |

59-70 |

15% |

71+ |

10% |

26%

of our Conscientious Consumers reside in China

Where

Conscientious

Consumers

live

China |

26% |

France |

25% |

Germany |

23% |

USA |

13% |

U.K. |

13% |

of Conscientious Consumers are influenced by sustainability and environmental concerns

MOST USED PAYMENT METHODS

#1 TOP CHOICE PAYMENT METHOD

Conscientious Consumers data

20 / 32

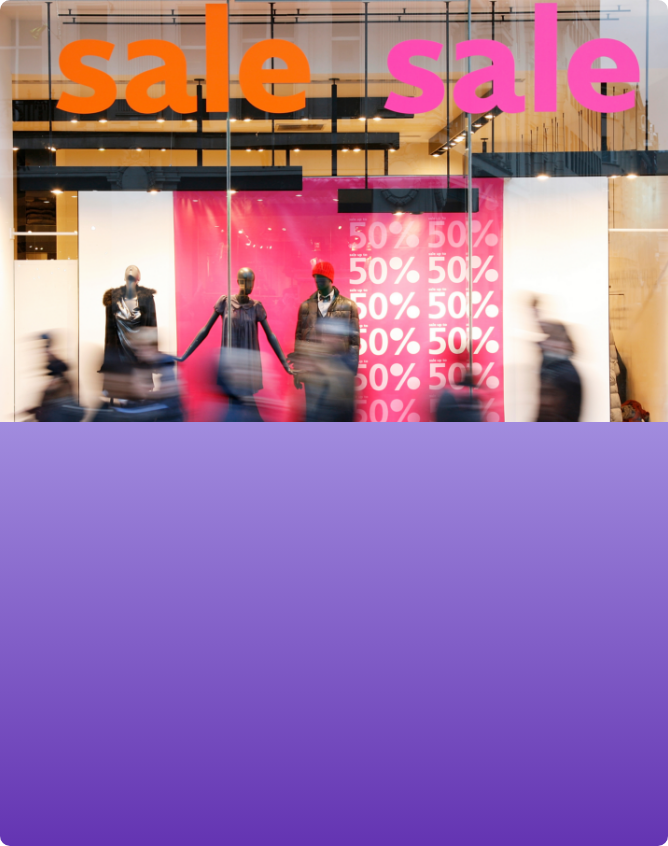

Ralph and Ernesto, 31 and 39

BARGAIN HUNTERS

The art-loving couple own an Etsy store selling prints and posters, and favor marketplaces and physical markets over department and direct-to-consumer stores. Fast becoming successful business owners, looking for bargains is built into their DNA and they take pride in never purchasing a product at full price.

If you’re a Bargain Hunters…

You love an offer! You’re committed to brands that offer loyalty schemes with rewards points, sales and discounts. Though you may favor key stores, you can be tempted away by the best deals. You may also be likely to purchase items that are pre-loved from marketplaces such as eBay, Amazon and Etsy to grab that bargain before someone else does!

At a glance

21 / 32

Everyone loves a bargain! This adage is close to true based on what our shoppers say. With a quarter identifying as a Bargain Hunter as their primary shopper type, and a further 28% identifying it as their second, over half of all respondents felt very strongly that seeking deals is part of their shopping DNA.

This is the group motivated most strongly by price, with 62% selecting it as their primary motivation for choosing a retailer.

Lengthening sales seasons and having more flash sales could lead to considerable gains for merchants, as well as ensuring reward schemes lead to monetary savings.

22 / 32

23 / 32

23%

of our Bargain Hunters are aged 43-58

Global Bargain

Hunters

by age

18-26 |

18% |

27-35 |

20% |

36-42 |

20% |

43-58 |

23% |

59-70 |

9% |

71+ |

10% |

31%

of our Bargain Hunters reside in the U.K.

Where

Bargain

Hunters

live

U.K. |

31% |

USA |

26% |

Germany |

20% |

France |

18% |

China |

5% |

of Bargain Hunters are motivated by price when choosing a retailer

MOST USED PAYMENT METHODS

#1 TOP CHOICE PAYMENT METHOD

Bargain Hunters data

24 / 32

Alice, 59

BASICS BUYER

She’s got more important things to do than shopping, but newly promoted in her job, wants to come across as professional without looking like she’s tried too hard. She has identified the quality brands and replenishes only when things get tatty.

If you’re a Basics Buyer…

You only purchase what you need – just the basics. What you do buy should be built to last or multi-purpose. When it comes to grocery shopping you may have a regular list from which you don’t often diverge. You favor quality over quantity, often returning to the same trusted brands. For you shopping is about necessity, not pleasure.

At a glance

25 / 32

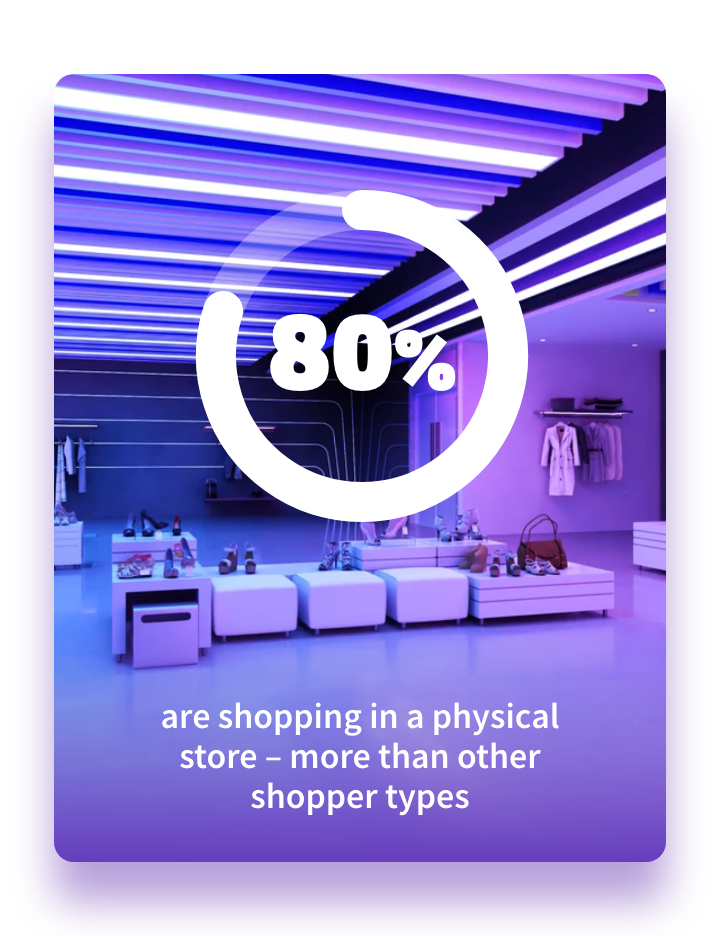

With this group making up 57% of shoppers either as their #1 or#2 identity – and shopping in a careful and considered fashion – work hard to get their attention over competitors.

They are also shopping through the fewest channels, so retailers may find it slightly harder to reach and engage them. Whilst some Basics Buyers do make impulse purchases, they’re less likely to than the other groups, with 80% either doing so only occasionally or not at all. Furthermore, only 14% of those identifying as Basics Buyers as their primary type had taken advantage of Buy Now, Pay Later in the last year.

Displaying some similarities to Bargain Hunters, they make more of their purchases through either online marketplaces (76%) or physical stores (78%). They are also less likely to value personalized recommendations and are less motivated to spend more on perks, since their approach is to only buy what they need. However, they still do value loyalty schemes highly, with 83% thinking online loyalty schemes will be important in the future.

26 / 32

27 / 32

24%

of our Basics Buyers are aged 43-58

Global

Basics Buyers

by age

18-26 |

17% |

27-35 |

18% |

36-42 |

20% |

43-58 |

24% |

59-70 |

11% |

71+ |

10% |

24%

of our Basics Buyers reside in China

Where Basics

Buyers live

China |

24% |

France |

23% |

Germany |

19% |

USA |

18% |

U.K. |

16% |

of Basics Buyers have made a purchase through an online marketplace

MOST USED PAYMENT METHODS

#1 TOP CHOICE PAYMENT METHOD

Basics Buyer data

28 / 32

Whilst each type of shopper has their own interests, needs and nuances, there are core fundamentals that shoppers value: good price, convenience and loyalty, as well as some behavioral overlaps between personas.

We are in an age of economic anxiety which is further shaping what people prioritize in their lives, so itʼs a good time for merchants to consider how they can alleviate some of the burden: perhaps through accepting flexible payments, giving back meaningful rewards and simply by providing entertainment and fun!

Bargain Hunters and Basics Buyers shop through fewer channels and are almost exclusively motivated by price, rewards and offers. With them potentially making more considered choices, merchants may want to look at their loyalty schemes and ensure theirs goes beyond what is standard, offering rewards that just keep drawing shoppers back.

Aspirational Shoppers and Trendsetters lead the adoption of new retail technologies like augmented reality and livestreaming, as well as asserting that a joined up omnichannel experience is paramount.

Merchants may be able to engage these groups more deeply with brand offers, exquisite website curation and social presence, as well as through style, ethos and brand identity.

Finally, whilst Conscientious Consumer was a shopper type, 73% of all shoppers thought sustainability and environmental impact might contribute to where they shop in the future, showing that along with the importance of low price and good rewards, ESG will be paramount to keeping future shoppers happy.

Yes, we are all individuals, but if retailers focus on optimizing the following, we think they will have a good chance of winning our Future Shoppers over and keep them coming back for a while to come.

30 / 32

TOP TAKEAWAYS TO

SATISFY FUTURE SHOPPERS

All our shopper types are motivated by price. As well as providing frequent offers, consider free shipping & returns and flexible ways to pay to alleviate financial pressures.

Make your loyalty schemes meaningful. What was once deemed ‘good’ is no longer enough: loyalty schemes may need to be gold-standard to stand apart.

Shoppers want their spending habits to be votes for what they care about. Make sure you reflect what’s on your shoppers’ minds and lead the way in driving positive change.

Shoppers of all ages are open to innovations that improve the shopper journey. What once seemed futuristic is now the norm. Consider speeding up your innovation roadmap: your shoppers are ready!

Style-savvy shoppers like Trendsetters are brand afficionados who care about curation and image. Ensure your brand is consistent in taste and tone right across every customer touchpoint.

31 / 32

Methodology

This report is based on data collected in a survey of over 5,000 consumers in five countries fielded by the market research firm Savanta between June and August 2023. Respondents were asked to self-identify as shopper personas based on their personal attitudes, choosing from six descriptions. All projections are subject to changes in world events, market dynamics and other macro-economic forces. Any indicative predictions should be treated as such.

About Worldpay

Worldpay payment processing solutions allow businesses to take, make and manage payments in-person and online from anywhere in the world. Worldpay solutions, which supports approximately 225 markets in 146 countries and in nearly 135 local currencies, are offered by FIS, a leading provider of technology solutions for merchants, banks and capital markets firms globally. FIS is a Fortune 500® company and is a member of Standard & Poorʼs 500® Index. To learn more, visit fisglobal.com Follow Worldpay on Facebook, LinkedIn and X, formerly Twitter (@Worldpay_Global).

November 2023

32 / 32

Back to meet the shoppers

Back to meet the shoppers